What are you looking for Popular Services File your return Make a payment Check your refund Register for sales tax Featured Resources Choose an online service We offer a number of online services to fit your busy lifestyle.

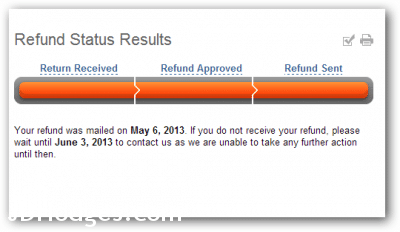

#Irss tax refund status verification#

If this is the case, you should receive IRS letter 5071c requesting you to contact the IRS Identity Verification telephone number provided in the letter or take other steps. Even if you did not request a direct deposit, these types of refunds are directly deposited into the preparer’s financial institution, so you should contact the preparer for resolution. You can use the IRS Wheres My Refund tool to check the status of your refund within 24 hours of e-filing. The IRS has specific programming to review tax returns to identify instances of possible identity theft, which can also cause a delay in issuing a refund. Usually this occurs when you authorize the fee for preparation to be taken from your refund. You requested a Refund Anticipation Loan (RAL) or Refund Anticipation Check (RAC) through your preparer or preparation software.We will issue a paper check for the amount of that deposit once it is received. You incorrectly enter an account or routing number and the number passes the validation check, but the designated financial institution rejects and returns the deposit to us. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.In this case, we will send you a paper check for the refund instead of a direct deposit. You omit a digit in the account or routing number of an account and the number does not pass our validation check. After the IRS accepts your return, it typically takes about 21 days to get your refund.Both options are available 24 hours a day, 7 days a week, and have the same information as our customer service representatives, without the wait of the phone queue. The following are some common issues with direct deposits and how they are handled: Check your refund status Use our Where’s my Refund tool or call 804.367.2486 for our automated refund system. Once the funds are returned, we will issue a paper check to the address indicated on your return. In general, if you have an issue with your direct deposit, such as closing your bank account after you submitted your return, the financial institution will return the funds to us.

We are not responsible for a lost refund if you entered the wrong account information for a direct deposit.

0 kommentar(er)

0 kommentar(er)